Confirmation of Legal Blindness form free printable template

Show details

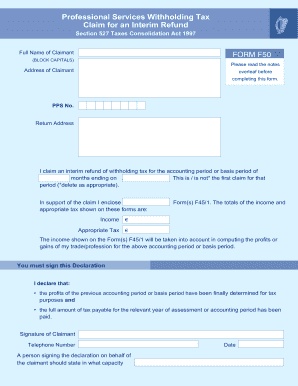

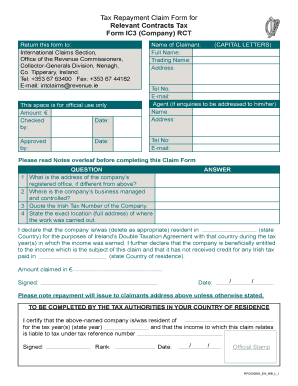

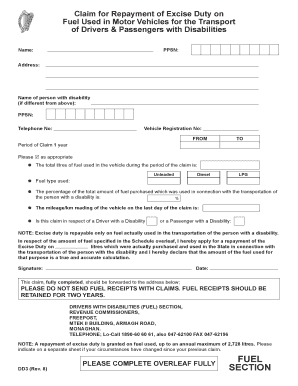

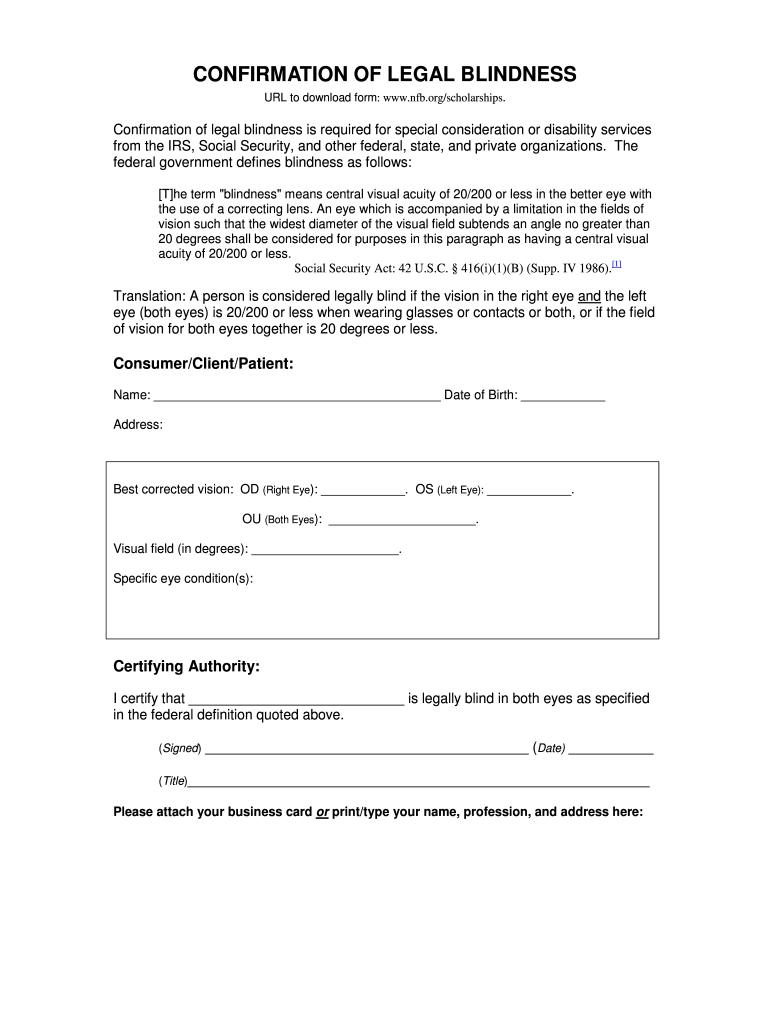

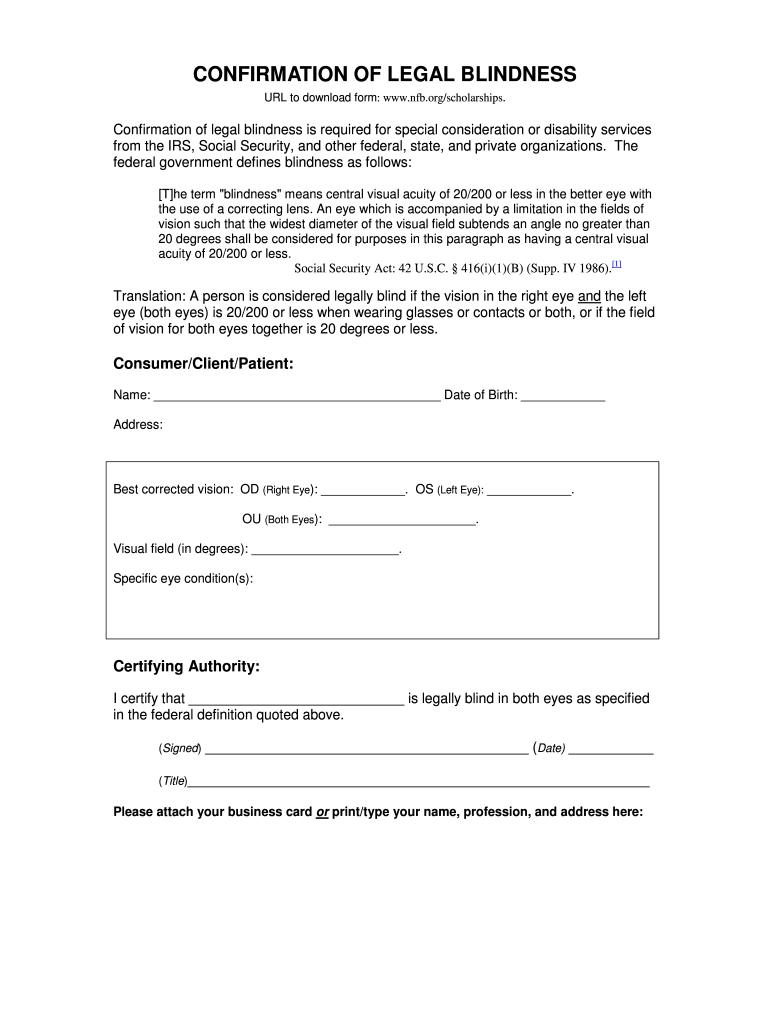

CONFIRMATION OF LEGAL BLINDNESS URL to download form www. nfb. org/scholarships. Confirmation of legal blindness is required for special consideration or disability services from the IRS Social Security and other federal state and private organizations. The federal government defines blindness as follows T he term blindness means central visual acuity of 20/200 or less in the better eye with the use of a correcting lens. An eye which is accompanied by a limitation in the fields of vision such...

pdfFiller is not affiliated with any government organization

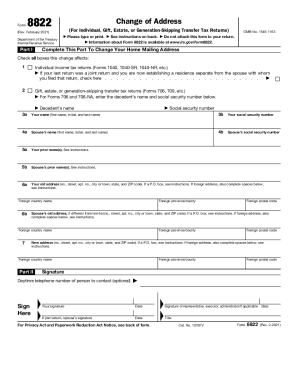

Get, Create, Make and Sign irs legally blind form

Edit your blind forms legally form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your confirmation of legal blindness form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit legally blind forms online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit irs form for legally blind. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out legally blind letter form

How to fill out Confirmation of Legal Blindness form

01

Obtain the Confirmation of Legal Blindness form from the appropriate agency or website.

02

Fill out personal information including name, address, and contact details at the beginning of the form.

03

Provide details about your vision impairment, including the extent of visual impairment and any medical records if required.

04

Include information about your eye care professional or doctor who can verify your condition.

05

Sign and date the form to certify that the information provided is accurate.

06

Submit the completed form to the designated agency or office as instructed.

Who needs Confirmation of Legal Blindness form?

01

Individuals with significant vision impairment who need to document their legal blindness status, typically for eligibility for assistance programs, benefits, or services.

Fill

certificate of legal blindness

: Try Risk Free

People Also Ask about irs legally blind form pdf

How does the IRS define legally blind?

Blind. You are considered blind if: You cannot see better than 20/200 in your better eye with glasses or contact lenses, or. Your field of vision is not more than 20 degrees.

How do you prove you are legally blind?

We consider you to be blind if your vision can't be corrected to better than 20/200 in your better eye. We also consider you blind if your visual field is 20 degrees or less in your better eye for a period that lasted or is expected to last at least 12 months.

Do you get a tax break for being legally blind?

A blind taxpayer is any individual in the U.S. whose lack of vision qualifies them for a special tax deduction ed to blind persons. Blind taxpayers get the same standard deductions as taxpayers over age 65. For 2020, $1,650 is the additional amount of the blind taxpayer deduction for individuals filing as single.

What is the tax deduction for legally blind in 2022?

For 2022, the additional standard deduction amounts for taxpayers who are 65 and older or blind are: Single or Head of Household – $1,750 (increase of $50) Married taxpayers or Qualifying Widow(er) – $1,400 (increase of $50)

How do I claim legally blind on my taxes?

How to Claim the Legally Blind Tax Deduction Take the standard deduction. Get a letter from your ophthalmologist or optometrist certifying that you are legally blind. Keep this letter for your records. File your taxes using Form 1040 or 1040 SR.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send legally blind tax form for eSignature?

To distribute your the confirmation of legal blindness form is a critical document must adhere to specific criteria, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Where do I find legally blind?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the confirmation of legally blind paperwork. Open it immediately and start altering it with sophisticated capabilities.

How can I edit legally blind documentation on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing legal blindness form.

What is Confirmation of Legal Blindness form?

The Confirmation of Legal Blindness form is a document used to officially certify an individual's visual impairment status, indicating that they meet the criteria for legal blindness as defined by specific guidelines.

Who is required to file Confirmation of Legal Blindness form?

Individuals who wish to apply for certain benefits or services that require proof of legal blindness, such as specific disability programs, are required to file this form.

How to fill out Confirmation of Legal Blindness form?

To fill out the Confirmation of Legal Blindness form, individuals typically need to provide personal information, details regarding their visual impairment, and have a qualified eye care professional complete the relevant sections attesting to their visual status.

What is the purpose of Confirmation of Legal Blindness form?

The purpose of the Confirmation of Legal Blindness form is to provide official documentation of an individual's blindness status, which is necessary for accessing various disability-related services, benefits, and support.

What information must be reported on Confirmation of Legal Blindness form?

The information reported on the Confirmation of Legal Blindness form typically includes the individual's name, date of birth, details about their visual impairment (such as visual acuity and field of vision), and the signature of the certified eye care professional.

Fill out your Confirmation of Legal Blindness form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Forms Legally Blind is not the form you're looking for?Search for another form here.

Keywords relevant to when filling out the confirmation can verify the blindness status

Related to the irs legally blind form form 2441 requires you to administration or another government agency

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.